“We're observing a market redistribution.” How Bitcoin's hashrate growth affects miners

Bitcoin's processing power has reached record highs, while the industry is in uncertainty

05.10.2022

1051

6 min

1

The bitcoin hashrate reached an all-time high of 242 EH/s on October 3. At the same time, miners' yields sagged dramatically, and the average cost per coin is holding steady at roughly the current level of the first cryptocurrency's price.

According to a report by Glassnode published on October 4, the increasing difficulty of mining bitcoin has triggered an increase in its cost of production, which put even more pressure on miners, whose income has just begun to recover from the recent capitulation. The company's analysts use two models to calculate miners' costs per bitcoin, which put the cost per BTC between $12 140 and $18 300 under current market conditions. “miners are somewhat on the cusp of acute income stress,” the report's authors write.

Amid such fluctuations, the bitcoin price has remained fairly stable, consolidating in an increasingly narrow range between $19 921 and $20 239, Glassnode analysts said. Such long calm periods are uncharacteristic of bitcoin, something similar was observed both before the market collapsed in November 2018 and preceded a bullish rally in March 2019.

According to Sergey Mendeleev, head of InDeFi Smart Bank, the rise in hashrates suggests that both hardware manufacturers and miners believe the market is starting to grow soon, and that they are finding options for using cheap electricity. “On the other hand, the current bitcoin price is still profitable for miners, which means it could easily fall below the pain line when the latter start unplugging equipment, as they did in early 2020,” Mendeleev reasoned.

Bitcoin runs on a Proof-of-Work (PoW) consensus mechanism at the expense of miners, whose equipment is engaged in complex mathematical calculations to produce new blocks and write them into the blockchain. The hashrate reflects the amount of computing power devoted to this work at any given time. A value of 242 EH/s (exahashes per second) reflects a very significant amount of performance. Glassnode estimates that if all 7.753 billion people on the planet made 30 billion calculations every second, that would be the approximate equivalent of bitcoin's processing power.

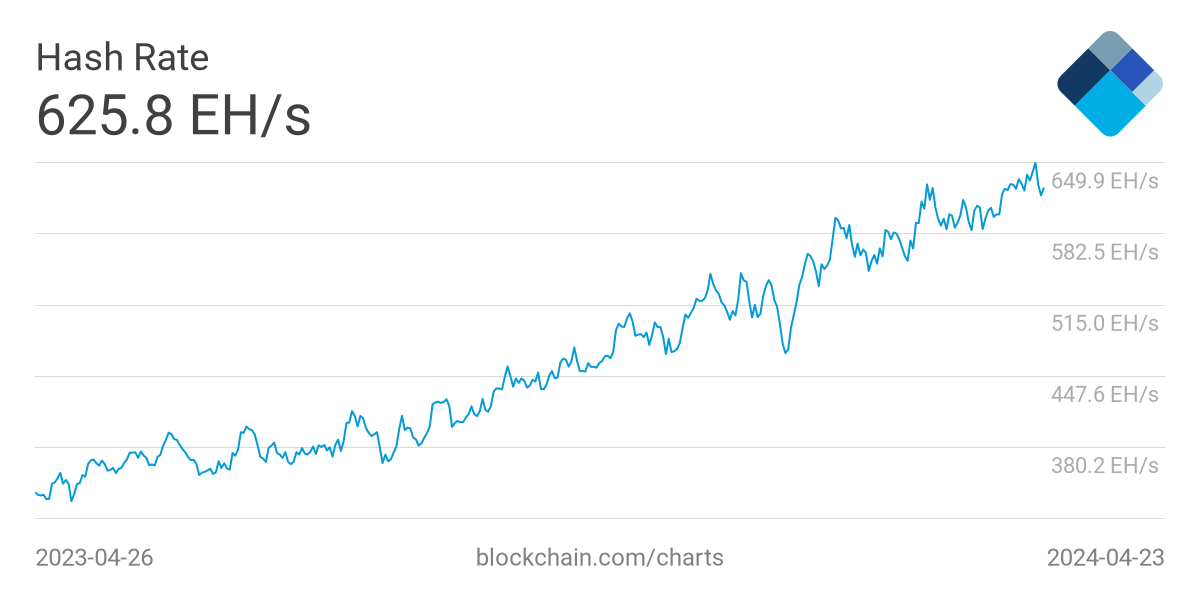

BTC hashrate chart for the year

Bitcoin's previous maximum processing power was recorded in early June at 230 EH/s, but the cryptocurrency's price drop from $28 000 to $18 000 also led to a decline in the hashrate to 193 EH/s. Such a sharp decline in the indicator was previously observed only in the summer of 2021 when the ban on mining in China forced local industrial bitcoin miners to shut down equipment and move it to more cryptocurrency-loyal states.

Market redistribution

The June price drop also triggered a capitulation of miners, dramatically losing earnings that had already sagged compared to last year. This triggered pressure on most of the big players, forcing them to sell both mined bitcoins daily to cover expenses and to survive in the market as a whole.

“I think we are now observing a redistribution of the mining market,” ENCRY Foundation co-founder Roman Nekrasov commented. As the current bitcoin price fluctuates near the average cost of production, some miners whose production costs are higher than the global average may already consider stopping operations. In such a situation, large mining companies that have sufficient funds at their disposal to maintain operations even in conditions of low prices will try to capture market share, the expert believes.

According to Nekrasov, those whose production costs (e.g. electricity prices) are lower than the global average may act in the same way. Such miners, put in more favorable conditions, may try to launch additional computing capacities and also take a market share. The whole situation carries certain risks of consolidation of computing power in the hands of large miners, and this negatively affects the decentralization of the bitcoin network. “However, in general, bitcoin is quite resistant to such risks, and it's not the first time that its price has fallen to production cost level,” Nekrasov notes.

The mining market can be called self-regulating, the major players are always on the lookout for cheap power sources and the most mining-loyal jurisdictions around the world. Optimizing the cryptocurrency mining process allows them to reduce costs and maximize profits. The more participants join the market, the more difficult bitcoin mining becomes. As the difficulty increases, those who have mining revenues that barely cover their costs are washed out of the market. This, in turn, reduces the difficulty, giving other miners a chance to join or build up their capacity.

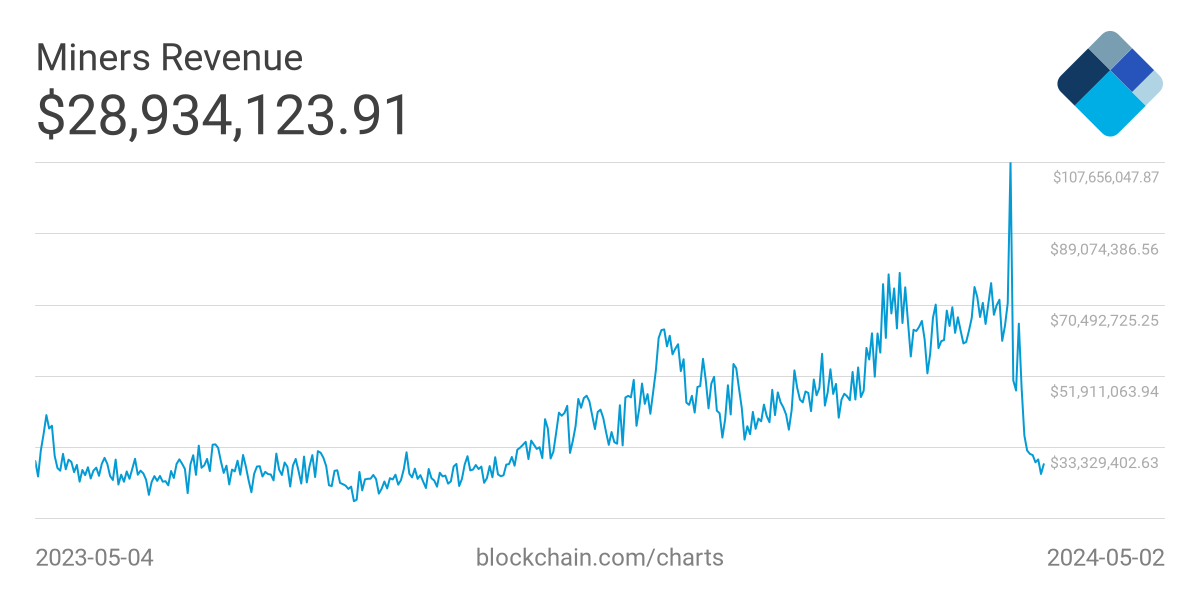

Chart of daily revenue of BTC miners

Miners' earnings are down more than 70% from last year. According to Blockchain.com, miners earn about $20 million a day, compared to an average of about $60 million a day last year and more than $74 million at market peaks in November, when bitcoin hit an all-time high (ATH).

New conditions

Miners were hit not only by the bearish period on the crypto market but also by the global energy crisis, which became a catalyst for rising electricity prices. Compute North, an American data center operator for mining filed for bankruptcy after failing to pay its creditors. One of the leading mining pools, Poolin, which accounted for 12% of all bitcoin hashrate back in September, announced liquidity problems, causing its share of global BTC mining to drop to 3,7%. The new realities forced some companies to use borrowed funds to expand their businesses and take out debts, including those secured by the equipment.

After the ban on mining in China, local players began to move equipment to states where they were able to launch production facilities and adapt to local conditions affecting their operations. As a result, the US share in the global bitcoin hashrate increased dramatically, with the state positioning itself as one of the most favorable in terms of conditions for miners to relocate. Significant amounts of equipment also settled in Russia or Kazakhstan, where a mining licensing bill was drafted in late September. It was reported that Russia plans to export to Kazakhstan electricity for miners, while inside Russia there is a discussion on the regulation of mining at the level of the Ministry of Finance and the Central Bank.

Roman Nekrasov calls the legislative initiatives in Russia unclear in terms of the consequences for the global bitcoin mining market. Perhaps it is just Russian miners who are trying to increase their share in the global market by means of cheap electricity, the expert admits.

Modern mining is a multibillion-dollar industry with its own rules, R&D, and players, says Sergey Mendeleev. “It is painful for me to look at the current situation with the legal regulation of mining in the Russian Federation. We could have become a world center of bitcoin production in the last 5-6 years, but instead, we thoughtlessly prohibit everything we don't understand. The market has formed, and now we can only be in the role of catching up,” sums up the head of InDefi. According to him, important and necessary bills on mining, such as the one proposed by the New People party, are rejected by the profile committees.

Useful material?

Articles

How the largest cryptocurrency exchange’s initiatives help it maintain its leadership

Nov 19, 2022

Articles

What fan coins are needed for and what events contribute to their growth

Nov 16, 2022

Articles

Why Binance set the trend to publish transparent data on available funds

Nov 14, 2022

Articles

The journalists got acquainted with the documents revealing the details of the financial condition of the exchange

Nov 13, 2022

Articles

Desperate traders with stuck assets resort to semi-legal schemes to save deposits

Nov 11, 2022

Articles

Experts predict when to expect new peaks of the crypto market by analyzing its previous cycles

Nov 10, 2022

Telegram

Telegram  Twitter

Twitter